In response to the Stop Senior Scams Act, the FTC brought together an Advisory Group of government partners, consumer advocates, and industry representatives. The Advisory Group formed four committees to collaborate, develop ideas, share suggestions and insights, and identify some actions organizations can take to help older adults spot, avoid, and report scams.

The methods, lies, and tactics scammers use to defraud older adults are constantly changing — and can be individually tailored for maximum effect. Their tactics are amplified across contact methods (phone, text, email, social media, websites) and executed through various payment platforms (money transfers, cryptocurrency, gift cards, peer-to-peer, credit and debit cards). To examine and develop improved approaches to address these many dimensions and intersections of scams, the FTC brought together representatives from diverse sectors, disciplines, and organizations. Together, these organizations focused on four main areas: 1) improving industry training on scam prevention; 2) reviewing research on effective consumer messaging to prevent fraud; 3) expanding consumer education and outreach efforts; and 4) identifying innovative or high-tech methods to detect and stop scams.

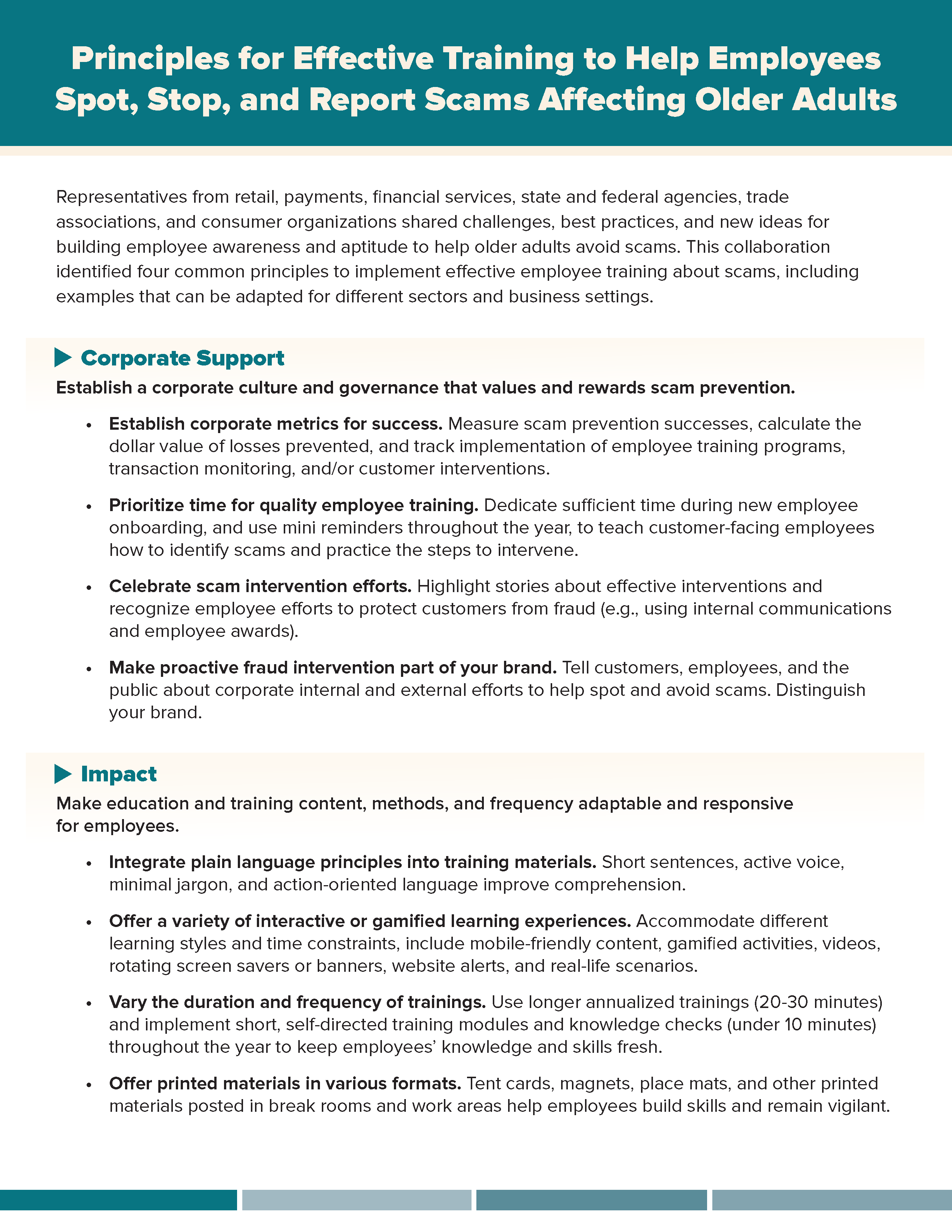

Although there’s no one-size-fits-all training solution that works for all types of industry, this cross-sector collaboration led to a set of principles for training employees to mitigate scams affecting older adults. These principles can guide any industry sector to develop effective training programs for employees.

Learning from the relevant research is a good place to start in developing better interventions. This group from government, industry, academic institutions, and others scanned the research landscape on scam prevention messaging, summarized the findings, and identified gaps in the research and questions warranting further exploration. The collaboration prepared a report of their takeaways and recommendations for much needed future research.

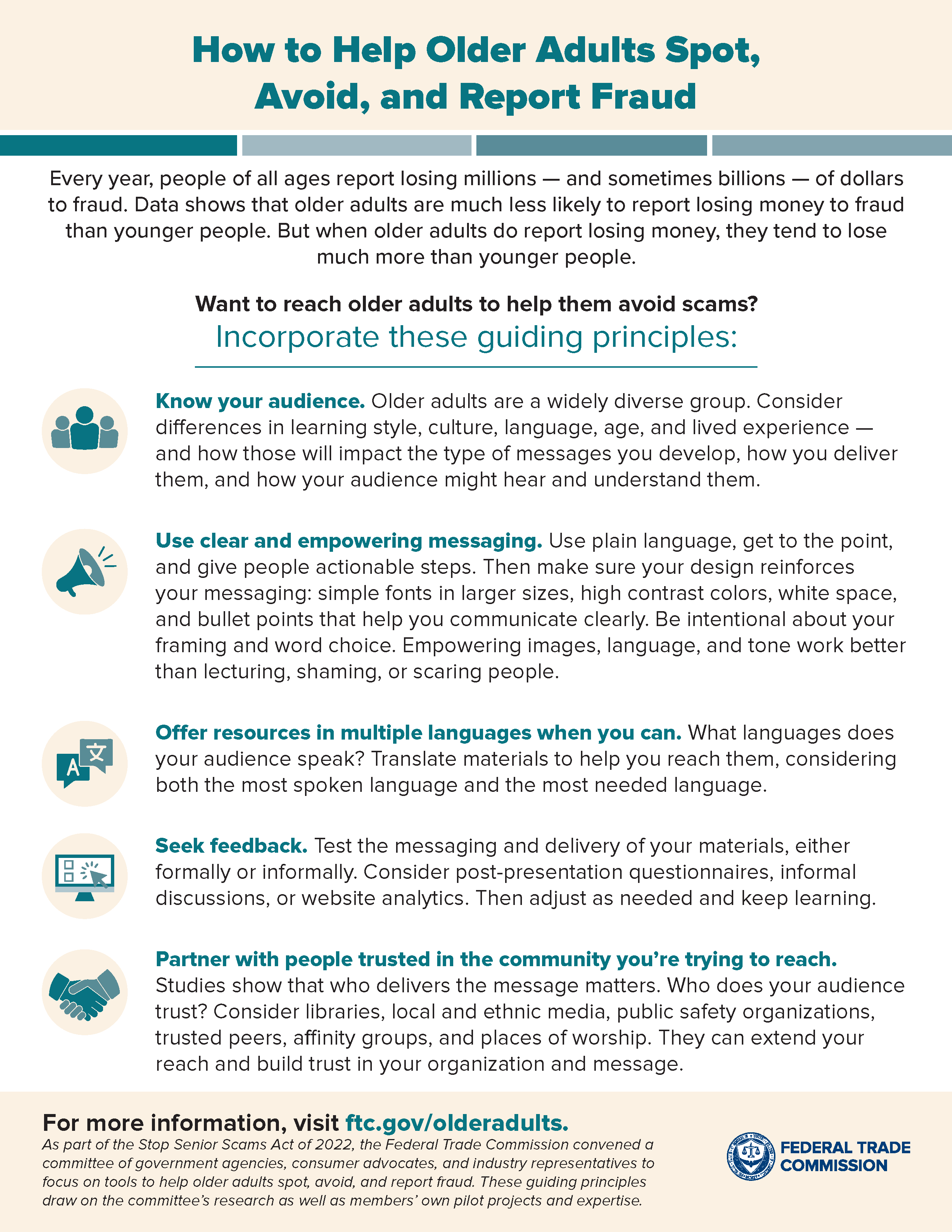

To better reach people with messages that help them spot and avoid fraud, a range of representatives, from local government to multinational corporations, collaborated to find principles that could guide any organization, of any size, in communicating with their target audience.

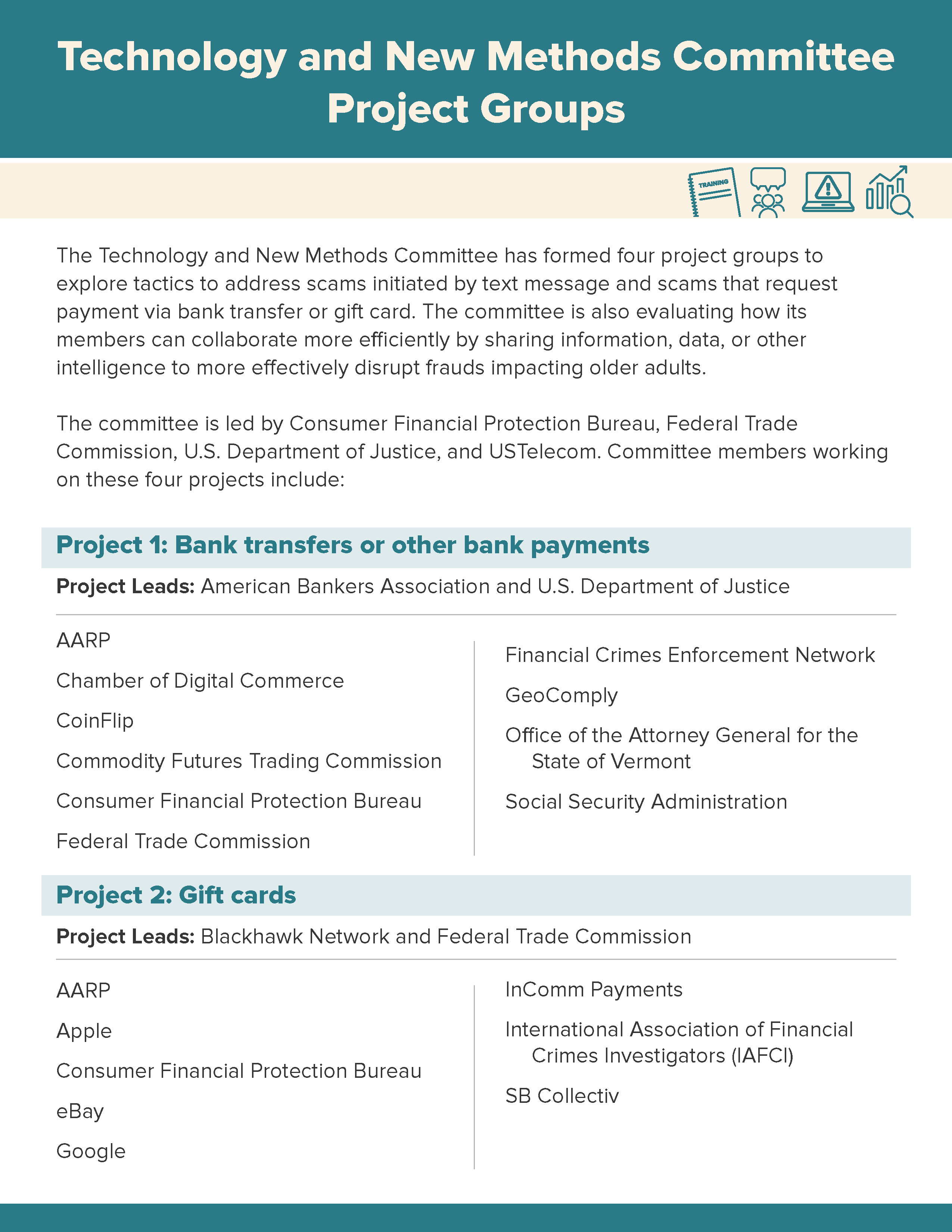

While technology can be a tool for scammers, it also plays a critical role to prevent and mitigate various scams. This group of industry, consumer advocates, and government representatives continues to explore the development and enhancement of technological tools to disrupt scams initiated by text, gift card scams, and bank transfers as payment methods. The group also is promoting information sharing to leverage best practices that help stop scams affecting older adults.

As part of its ongoing work, members of the Technology and New Methods Committee conducted research about state laws that permit financial institutions and broker-dealers or investment advisers to hold transactions that are suspected of being related to scams. These holds can make it harder for scammers to steal older adults’ money. The charts summarize the state law research findings. The American Bankers Association, a member of the Committee, also commissioned a survey asking its member banks about whether and how they utilize the state transaction hold laws.

Members of the Technology and New Methods Committee also prepared a guidance document summarizing some best practices that participants in the gift card industry can apply, as appropriate, to detect and prevent fraud.

In addition, members of the Technology and New Methods Committee prepared a document highlighting examples of existing information-sharing mechanisms for combatting fraud.

Learn about the Scams Against Older Adults Advisory Group, view advisory member biographies, find committee members, and more.