Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too. You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. (They’re not.) They’ll say they’re following up on your eligibility for a new loan forgiveness program, and might even know things about your loan, like the balance or your account number. They’ll try to rush you into acting by saying the program is available for a limited time. But this is all a scam. What else do you need to know to spot scams like this?

The only place to get help managing your federal student loans is StudentAid.gov. FSA (and your federal loan servicer) won’t ever pressure you to sign up for anything — but a scammer will. And sometimes, it’s easier to tell what’s real by learning to spot what’s not. To get you started:

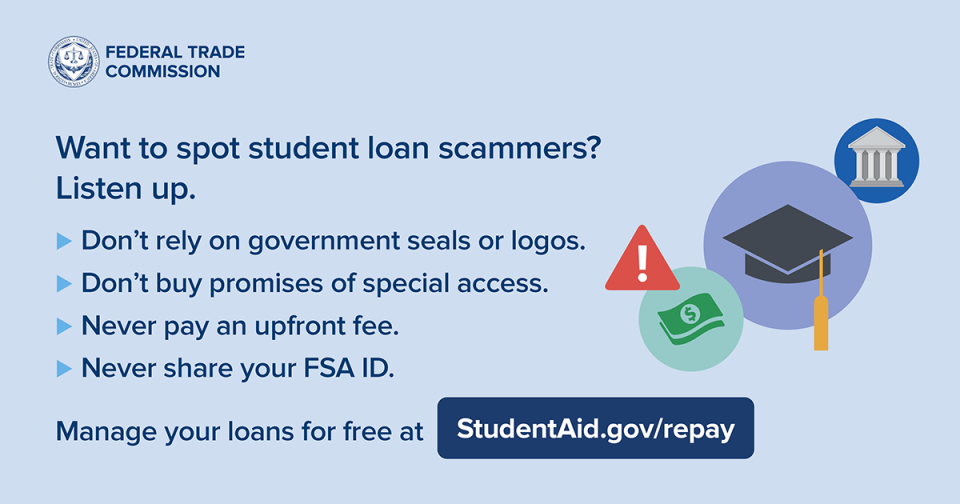

- Don’t rely on government seals or logos. Scammers use official-looking names, seals, and logos to make them seem more legit.

- Don’t buy promises of special access. There’s no special access to repayment plans or loan forgiveness programs. No one can get you into loan forgiveness programs you don’t qualify for or wipe out your loans. Use your FSA account dashboard to see which programs you might be eligible for.

- Never pay an upfront fee. It’s illegal for companies to charge you before they help you reduce or get rid of your student loan debt. And if you have to pay upfront, you might not get any help — or your money back. Get free help managing your federal loans at StudentAid.gov/repay. If your loans are private, go straight to your loan servicer for help.

- Never share your FSA ID login information. Only scammers say they need it to help you. If a scammer gets your FSA ID, they could cut you off from your loan servicer — or even steal your identity.

Check out FSA’s resources for avoiding student loan scams. And if you spot a student loan scam, tell the FTC at: ReportFraud.ftc.gov.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

- We won’t post off-topic comments, repeated identical comments, or comments that include sales pitches or promotions.

- We won’t post comments that include vulgar messages, personal attacks by name, or offensive terms that target specific people or groups.

- We won’t post threats, defamatory statements, or suggestions or encouragement of illegal activity.

- We won’t post comments that include personal information, like Social Security numbers, account numbers, home addresses, and email addresses. To file a detailed report about a scam, go to ReportFraud.ftc.gov.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

studentaid.gov actually helps the scammers with this, since it's easy for them to verify if your email address is registered with studentaid.gov. The site should state that it's going to send a password reset IF the email is on file but provide no indication if the email is registered or not. This makes it harder for the scammer to determine the legitimacy of the email.

The email sends a PIN to unlock and access the account. Scammers will ask for the PIN (they start a password lost action), and if that's provided, gives them access to the studentaid.gov account. They tell you it's for verification that you are you, and don't tell you that they are going to log into your account as you.

Sending a PIN to the account probably isn't a good idea, since if you give that PIN to a scammer, they can get into your account. A password reset link would be better, since you would have to have access to the email, and that's not something you could give to a scammer.

Simple changes could help reduce the impact of this scam.

The FSA ID has be renamed the "studentaid (dot) gov account" by the Department of Education, though most people are still calling it the FSA ID.

This is very instructive and helpful. Thanks

WOW! COLLEGE STUDENTS REALLY NEED THIS INFORMATION! THANKS SO MUCH FOR SHARING THESE SCAMS. THE ATTORNEY GENERALS IN EVERY STATE NEED TO CRACK DOEN ON THESE PUBLIC "SCAM ARTIST!" MANY BUSINESSES INCLUDING THE CAR DEALERS ARE TAKING ADVANTAGE OF WOMEN, ESPECIALLY! WOMEN ARE EASY PREY!

Add new comment