If the Coronavirus pandemic is causing you financial stress, you’re not alone. Millions of Americans have lost all or part of their income because they can’t work. Economic impact payments from the government might help, but some people may look for other ways to borrow money for a short period of time. They may consider options like a payday loan or a car title loan, which can be very expensive. Here’s what you need to know.

Payday loans

A payday loan is a loan made for a short time. Sometimes only two weeks. To get a payday loan, you give the lender a personal check for the amount you want to borrow, plus whatever fee the lender charges you. The lender gives you cash, minus the fee. On your next payday, you have to pay the lender the amount you borrowed plus the fee, in cash.

Payday loans can be very expensive. Here’s an example:

- You want to borrow $500. The fee is $75. You give the lender a check for $575.

- The lender gives you $500 in cash. He keeps your check.

- When it’s time to repay the lender, often in two weeks, you pay him $575. The lender gives you back your check.

- The bottom line: You paid $75 to borrow $500 for two weeks.

Car title loans

A car title loan is also a loan made for a short period of time. They often last for only 30 days. To get a car title loan, you give the lender the title to your vehicle. The lender gives you cash and keeps the title to your vehicle. When it’s time to repay the loan, you have to pay the lender the amount you borrowed plus a fee. Car title loans can be very expensive. Here’s an example:

- You want to borrow $1,000 for 30 days.

- The fee is 25%. To borrow $1,000, that’s $250.

- When it’s time to repay the lender in 30 days, you pay him $1,250.

Car title loans also are risky. If you can’t repay the money you owe, the lender might take your vehicle from you. He could sell it and keep the money, leaving you without transportation. This video shows what can happen.

Other ways you can borrow money

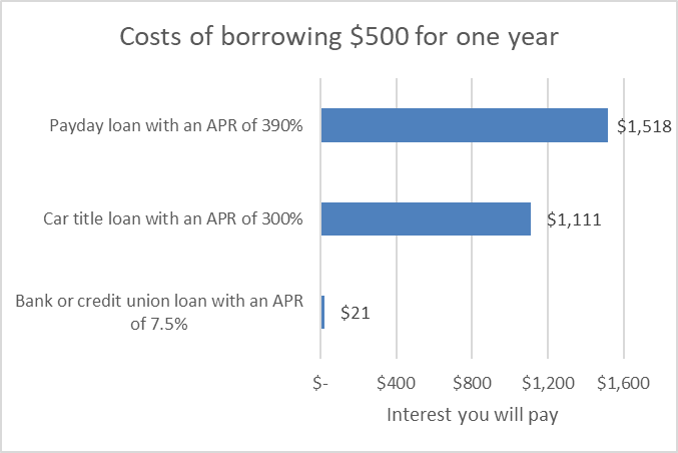

Payday loans and car title loans can be very expensive. Consider other ways of borrowing money, like getting a loan from a bank or a credit union.

Most loans have an annual percentage rate, or APR. The APR is how much it costs you to borrow money for one year. When you get a payday loan or cash advance loan, the lender must tell you the APR and the cost of the loan in dollars.

Here’s a comparison of the costs of borrowing $500 for one year.

What if I’m in the military?

If you’re in the military, the law protects you and your dependents. The law limits the APR on many types of credit, including payday loans, car title loans, personal loans, and credit cards, to 36%. The law also tells lenders to give you information about your rights and the cost of the loan. The military also offers financial help and help managing your money.

Other options if you can’t pay your bills

- Ask for time. Ask the companies you owe money to if you can have more time to repay the money.

- Get help. A credit counselor may be able to help you manage your debt.

- Apply for unemployment. Consider applying for unemployment insurance benefits from your state. Learn more and find out if you’re eligible on the Department of Labor website.

Get more tips about dealing with the financial impact of the Coronavirus, including what you can do if you’re: