The US Department of the Treasury and the IRS are working hard to get a second round of Economic Impact Payments (EIP) to people. You might have already gotten your payment direct deposited into your bank account. That started on December 29th. You might have gotten a check in the mail. But, like last time, some people will get their payment in the mail on an EIP VISA debit card. Don’t be surprised if the way you get this second round of payments is different than the first time. Whichever way you get your payment, it’s all money the government wants you to have, and quickly. So: if you qualify for an Economic Impact Payment, look at your bank account for a direct deposit, keep an eye out for a check in the mail, or watch your mailbox carefully this month for an EIP Visa debit card.

With checks, you know the drill: get the check, deposit the check. Since you might not have gotten money on a VISA debit card before, here’s a bit more info. The EIP VISA debit card will come in an envelope that looks like this:

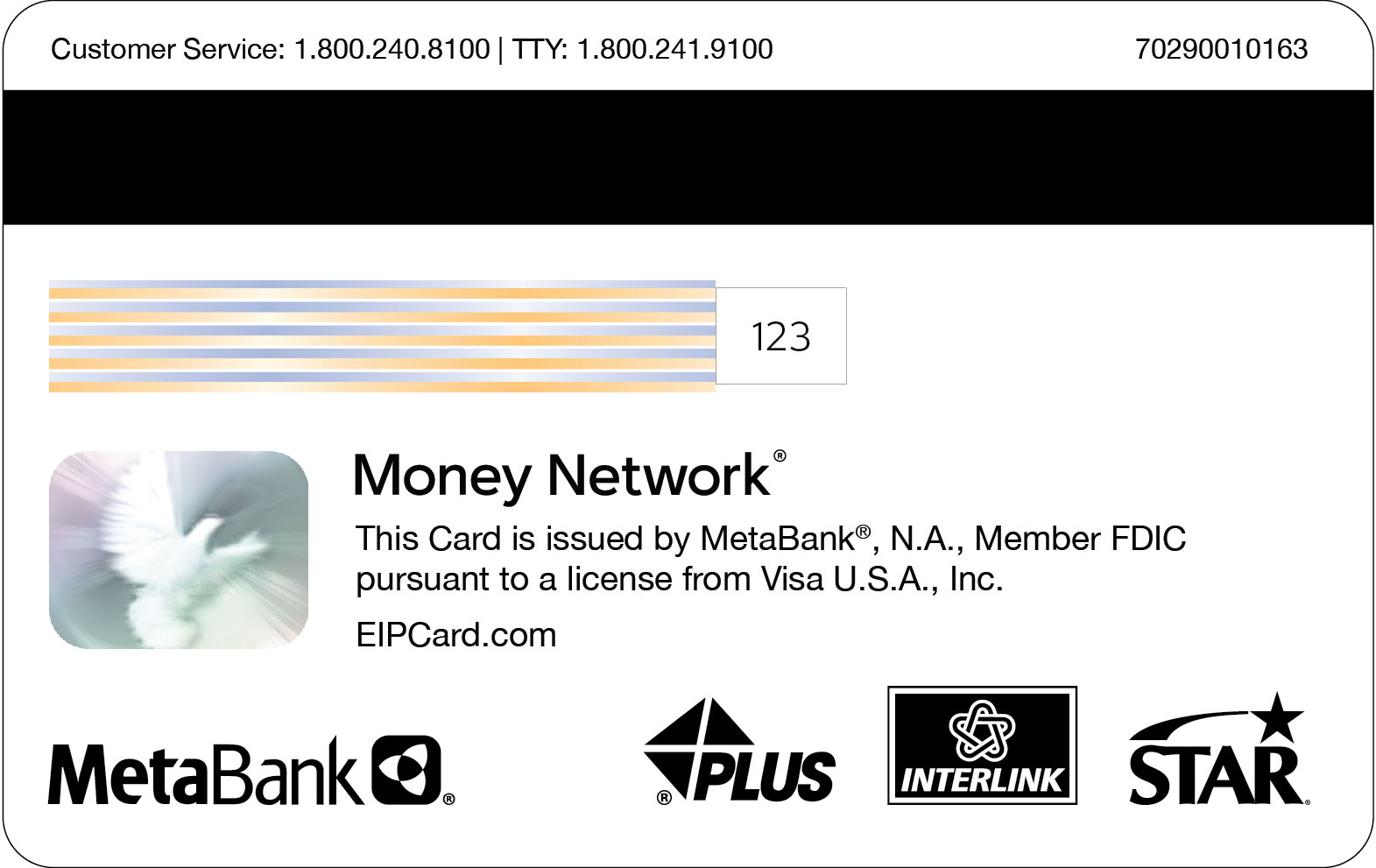

The debit cards are managed by Money Network Financial, LLC and issued by Treasury’s financial agent, MetaBank®, N.A., and will look like this:

If you got an EIP VISA debit card in the mail, here’s what to do.

- Activate the EIP VISA debit card right away by calling 1-800-240-8100. To activate your card, you’ll have to give the last six digits of your Social Security number. Once the card is activated, you can use it anywhere that accepts VISA debit cards, including online or in a store, or at an ATM to get cash. You also can transfer the money from the card to your personal bank account without fees. Keep in mind that the EIP debit cards will expire after three years. If that happens, call customer service to request the funds be sent to you as a check.

- Got questions about the EIP card? Call the 24-hour call center at 1-800-240-8100. You can also visit EIPCard.com for information on using your EIP card, like where to log in to see your card balance, or where to find an in-network ATM to get money out of the card at no charge.

- Got more general EIP questions? The IRS also has an FAQs page in English, or in Spanish.

And one last thing. Like last time, scammers are at work trying to get your money and/or personal information. Remember that the government will never call, text, email, or ask you to click on a link to activate your EIP card or get your money. If anyone does, it’s a scam. Don’t give anyone your personal or financial information, like your Social Security or bank account numbers. And never pay anyone to get your EIP funds. Report any scam immediately to the FTC at ReportFraud.ftc.gov.