For small businesses trying to stay afloat during the pandemic, a company that sold grant-writing services seemed to offer a lifeline. In a lawsuit, the FTC and State of Florida say the company promised to get businesses “guaranteed” grants of $25,000 to $250,000, depending on how much they paid for its services. But, the lawsuit says, those promises were false and businesses lost thousands of dollars each.

The lawsuit alleges that the company, Grant Bae, and its owner targeted minority-owned small businesses using social media platforms including Facebook, Instagram, and Clubhouse. The complaint says they falsely claimed that any minority-owned business that paid Grant Bae would get at least $25,000 in grant funding; promised that most Grant Bae clients would get funds within seven days of a grant’s “closing” date; and claimed they would apply for funds on behalf of business owners through the federal government’s COVID-19 Economic Injury Disaster Loan program.

But in most instances the defendants didn’t deliver on their promises, the complaint says. What’s more, according to the complaint, by the time business owners learned that Grant Bae wasn’t producing the promised grants and wasn’t honoring its “money-back guarantee,” it was often too late for them to dispute charges for thousands of dollars in fees that they had paid by credit card or other means.

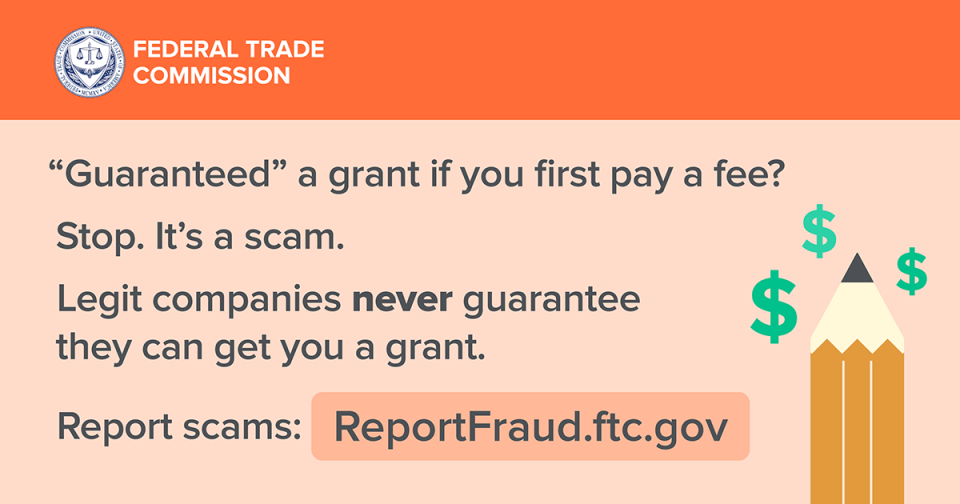

The case is a reminder that honest businesses will never guarantee that your business will get a grant or loan. Any company making that promise is a scam. Learn more about scams that target small businesses at our Protecting Small Businesses website.

For small businesses seeking advice on financing, business planning, human resources, and more, the SBA’s SCORE Business Mentoring Program has free consulting services. Free and low-cost counseling and training for minority-owned businesses also is available directly through the SBA or through its partnership with historically Black colleges and universities across the country.

Thank you for everything!!