Many school forms require personal and sensitive information. Here are some tips for keeping your child’s personal information safe — from pre-school through college.

- Safeguard your child’s Social Security number (SSN). Don’t carry your child’s Social Security card with you, and don’t share it unless you know and trust the other party. Ask why it’s necessary and how it will be protected. Ask if you can use a different identifier, or use only the last four digits.

- Know your rights under FERPA. The Federal Educational Rights and Privacy Act (FERPA) protects the privacy of student records. FERPA requires schools to notify parents and guardians about their school directory policy. It also gives you the right to opt out of sharing contact or other directory information with third parties, including other families.

- Limit what kids share online. Teach kids not to post their name, address or full date of birth on social media. For more tips, check out the FTC publication, Net Cetera: Chatting with Kids About Being Online. It offers practical tips and ideas for getting the conversation started about social networking, privacy, mobile devices, computer security, and dealing with cyberbullying.

- Use strong passwords on smartphones, tablets or laptops. Teach the importance of changing passwords – and not sharing them. This is especially important for college students in a dorm or other shared living space.

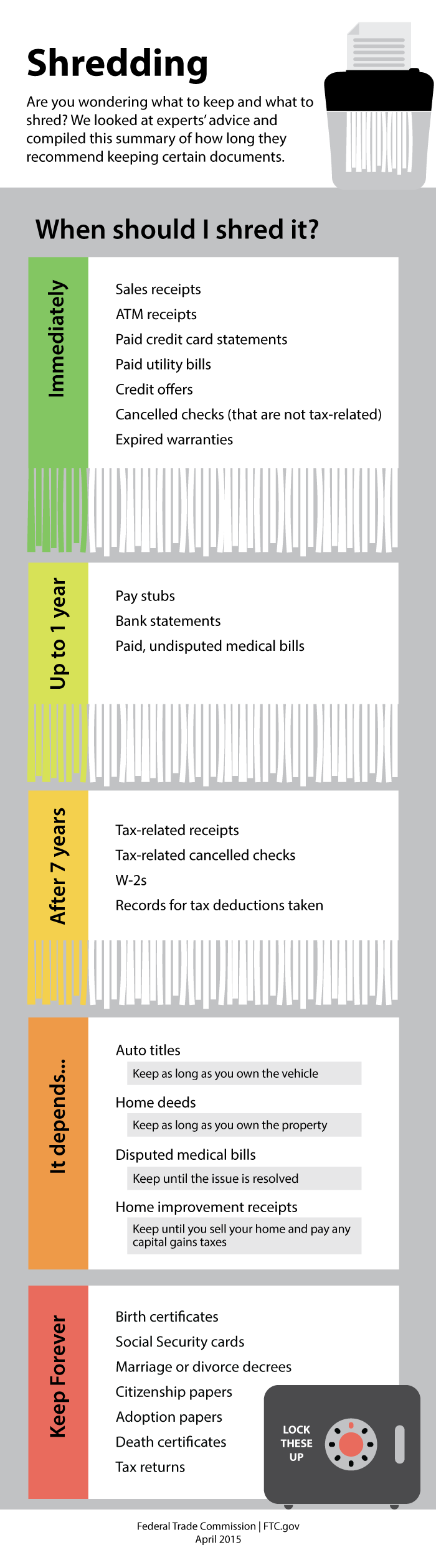

- Use a shredder. Shred all documents with your child’s personal information before throwing them away.

- Check whether your child has a credit report close to the child’s 16th birthday. If there is one — and it has errors due to fraud or misuse — you’ll have time to correct it before your child applies for a job, seeks a loan for tuition or a car, or needs to rent an apartment. Contact Equifax at 1-800-525-6285; Experian at 1-888-397-3742; and TransUnion at childidtheft@transunion.com.

If someone misuses your child’s information, go to IdentityTheft.gov to find out what steps to take.

In reply to Why keep tax returns forever? by Phil A.

In reply to Is this information available by inesc

We don't have the blog post in Spanish, but we do have the key items: