Giving Tuesday is a terrific time to support your favorite cause or charity. Here’s how to avoid charity scams and make your donations count.

-

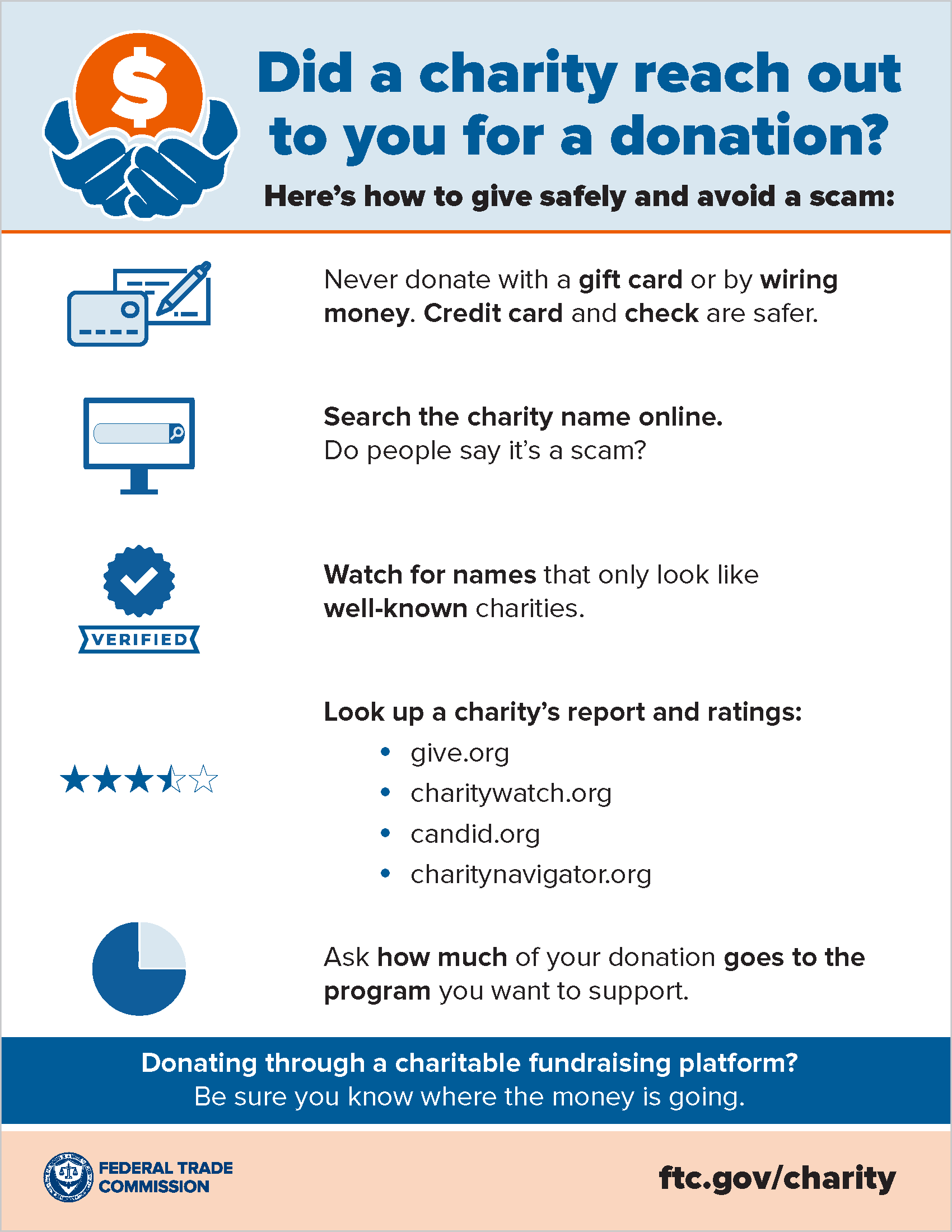

- Donate to charities you know and trust. Watch out for names that only look like real charities. Donate using contact information you know is real, like the charity’s website.

- Research the organization — especially if the donation request comes unexpectedly. Search the name plus “complaint,” “review,” “rating,” or “scam.” And check out the charity with the Better Business Bureau's (BBB) Wise Giving Alliance, Charity Navigator, Charity Watch, or Candid. If the message was from a friend, ask them if they know the organization themselves.

- Confirm the number before you text to donate. Go straight to the charity to confirm the number. If it’s not their number, use a number you know is real or go to the charity’s website to donate.

- Be cautious about donating to an individual in crowdfunding sites. Some scammers pretend to collect for a cause but their true intentions are to pocket your money. Giving to someone you personally know and trust is safest. Review the platform’s policies and procedures. Some crowdfunding sites will check out postings asking for help after a humanitarian crisis to confirm they’re legit. Others don’t.

- Don’t donate to anyone who insists you pay by cash, gift card, wiring money, or cryptocurrency. That’s how scammers tell you to pay. If you decide to donate, pay by credit card, which gives you more protections.

Share this infographic to help others spot and avoid charity scams. Go to ftc.gov/charity for more.

We can't just blame everyone just because of someone who did that to you! There are still lots of people like you and me. Never forget that please

All we want is to get rid of solicitations. Junk mail, robo calls, junk emails............

Question: Are "matching" contributions really matched? I'm getting mailings and email from many charities I regularly donate to -- recently, "matching every dollar up to 5 times." Of course, there is a top limit, e.g. "up to $100,000." Thank you.

Why cant I find a "charity's" financials on a FEDERAL or STATE website's "registry search tool"(CA DOJ, IRS) yet I can find them on private organization's websites (Charity Navigator, etc)? When I enter the 501(c)3 FEIN on GOVERNMENT websites, I cannot access recent 990 forms, yet I CAN on non-government sites? Why are independent organizations providing more transparency the the United States Government regarding entities that have been granted non-profit/NON TAXABLE 501(c)3 status?