Since we told you it’s time to ask for your money back from Western Union’s settlement with the FTC, we’ve gotten some questions about who can make a claim, when, and how it works. Here are some answers.

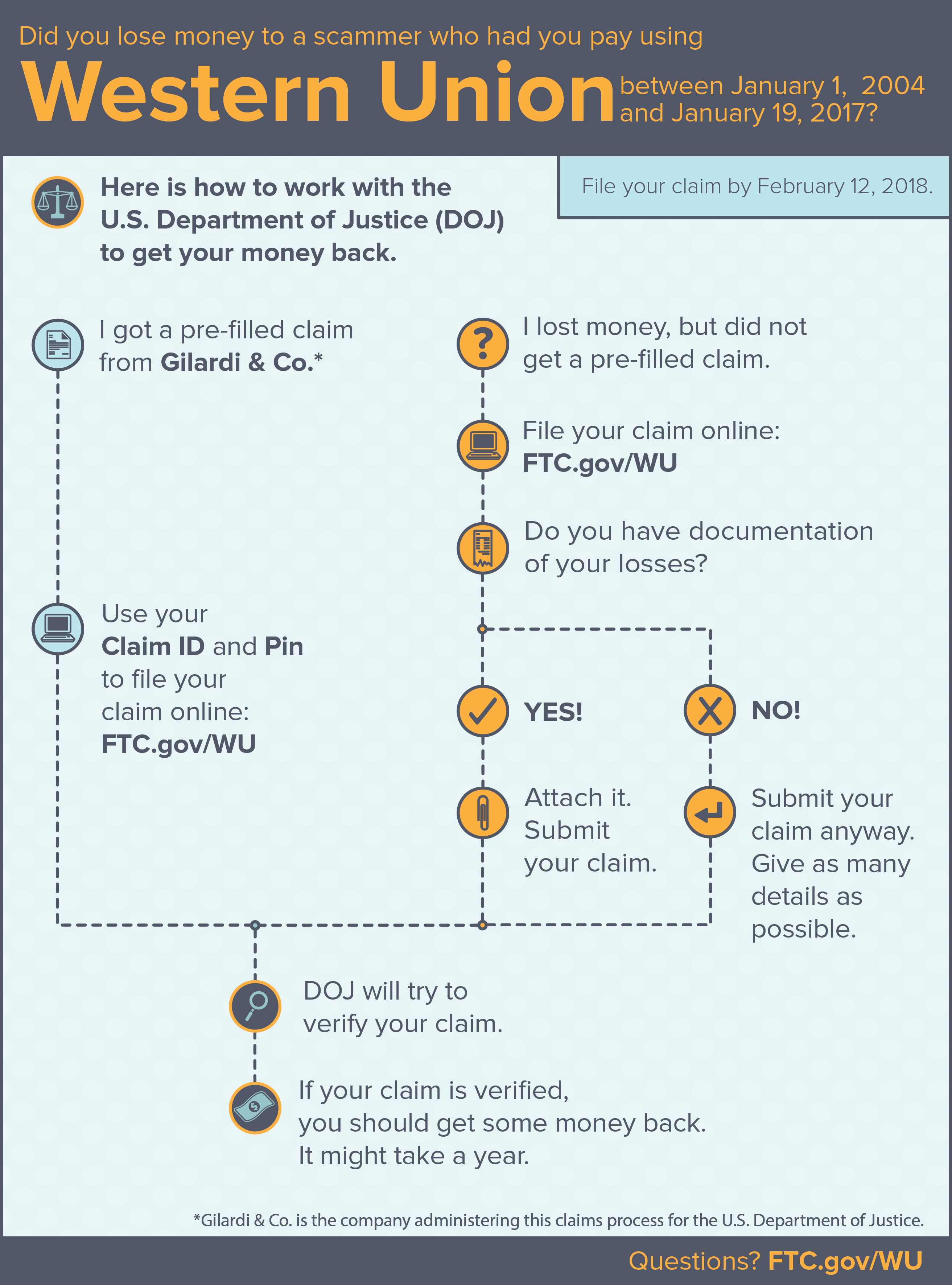

- If you lost money to a scammer who had you pay using Western Union between January 1, 2004 and January 19, 2017, you can file a claim. You have until February 12, 2018, to file your claim.

- You do not have to pay to get your money back. To file a claim, you have to give your Social Security number or Individual Taxpayer Identification Number (ITIN) on the claim form. But nobody will call you to ask for those numbers, or for your bank account or credit card number. Anyone who does is a scammer, so tell the FTC right away.

- If you don’t have either a Social Security number or an ITIN, check the box that says so. When asked for a reason, you can explain that you’re not a U.S. citizen – or whatever other explanation applies.

- The U.S. Department of Justice (DOJ) is managing the claims process through the company they hired, Gilardi & Co. Your claim will go to Gilardi, but we suggest you start at FTC.gov/WU, which will link you to the claims website.

- If you had reported your loss to Western Union, the FTC, or another government agency earlier, you might have gotten a pre-filled claim form in the mail. But even if you didn’t, you can still file a claim.

- To prove how much you lost, it helps to have documentation – like a receipt or transfer send form. If you don’t have those, file anyway. Give as much information as you can about your wire transfer and the money you lost, including when and why you sent it. That will help DOJ validate your claim.

- We know it’s not that safe to send your Social Security number through the mail to someone you’ve never heard of. That’s why we suggest filing your claim online, starting at FTC.gov/WU. But if you got a claim form in the mail from Gilardi and you want to return it by mail, the only address to send it to is: United States v. The Western Union Company, PO Box 404027, Louisville, KY 40233-4027.

- If you have power of attorney for someone, or you represent their estate, you can file a claim on their behalf.

- How much money you get back depends on how many people file a claim, and how many claims DOJ can validate.

- It might take a year for DOJ to process all the claims and send out checks.

Check FTC.gov/WU for updates and answers to other questions.

In reply to I've been waiting over a year by Lb1222

The company hired to handle the refunds - Gilardi & Co. - has not sent out decisions about who is eligible. The FTC's information page about refunds is www.FTC.gov/WU. Gilardi & Co. has information at www.WesternUnionRemission.com. You can check those pages for updates.

In reply to The company hired to handle by FTC Staff

In reply to I lost close to 11000 CAD in by rgoyalk

In reply to I find it funny that I get a by swtpea1022

In reply to I first filed in 2017 and by Patient Victim

On March 11, 2020, refund checks worth about $153 million started going out to over 109,000 people who sent money to scammers through Western Union wire transfers. Learn more at www.FTC.gov/WU.

In reply to On March 11, 2020, refund by FTC Staff

In reply to I filed a claim before the by Broke

In reply to what if you sent 2 separate by PMam

If you got a prefilled form from Western Union, read the Frequently Asked Questions on www.WesternUnionRemission.com.

The FAQ says you must give your Social Security number when you make a claim becuase, the federal Treasury Offset Program reviews claims to see if people owe money to the federal government before people can get a payment.

Read the FAQ to learn what to do if you don't agree with the dollar loss amount listed on the prefilled form.

In reply to I have been having major by Stelwarr

In reply to I’ve had the exact same by Mike

In reply to My name is Terri Springe my by Terrispringe

Please go to the Gilardi & Co website at www.WesternUnionRemission.com to get information about refunds.

Pagination