If you’ve been reading our new year, new credit series, then you have your credit report and learned how to read it. But what if you see mistakes? Maybe it’s an account that you didn’t open, an error in your name or address, or a bankruptcy that doesn’t really belong to you. Here are tips on fixing your credit, while avoiding scams.

If you see mistakes in your report, contact the credit bureau and the company that provided the information. Ask both to correct their records. Include as much detail as possible, plus copies of supporting documents, like payment records or court documents.

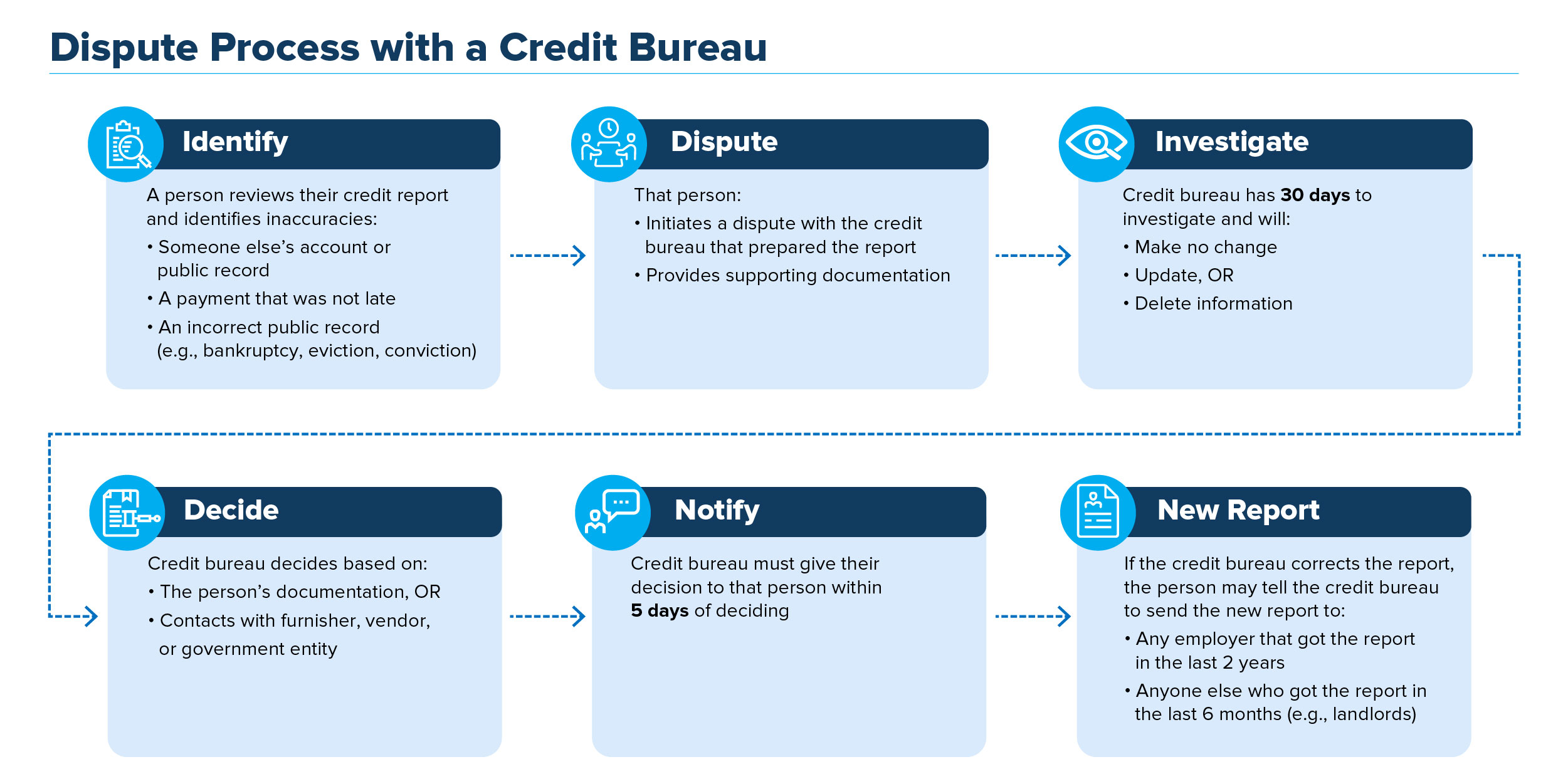

When contacting the credit bureau, the process depends on whether you’re an identity theft victim:

- If the errors are not related to identity theft: Tell the credit bureau (by mail or online) what information you think is inaccurate. By mail, you can use our sample dispute letters. Online, use the dispute portals for each credit bureau (Equifax, Experian, Transunion) that listed the inaccuracy. The credit bureau must investigate your claim and make any necessary updates to your information within 30 days. The bureau also must contact the company that provided the information. If the company finds the information was inaccurate, they must notify all three credit bureaus to correct your file.

- If the errors are due to identity theft: You can block identity theft-related debts from appearing on your credit report. Visit IdentityTheft.gov to learn the steps and to get an Identity Theft Report to send to the credit bureaus. Remember that you can use Identity Theft Reports only for debts that are the result of identity theft. Filing an Identity Theft Report to block debts that you owe is against the law.

If you’re considering paying a credit repair organization to help fix your credit, keep in mind that anything they can do for you legally, you can do for yourself at little or no cost. Credit repair organizations can NOT legally remove accurate negative information from your credit report.

If you hire a credit repair organization, don’t do business with one that:

- Insists you pay before it helps you (that’s illegal)

- Tells you not to contact the credit bureaus directly

- Disputes information in your credit report you believe is accurate

If you have a problem with a credit repair organization, report it to us. For more tips, read Fixing Your Credit, Credit Repair, and Credit Repair Scams.

In reply to Who do you go to when you by FAEAWW

If you've already tried reaching out to the credit reporting company and still have an issue, you can submit a complaint to the Consumer Financial Protection Bureau. The CFPB will forward your complaint the company and work to get you a response, generally within 15 days.

In reply to when companies close out your by Algablase

This FTC article explains what affects your credit score.

In reply to Is it necessary to fix minor by Marnix van Ammers

You have to decide if you want to go through the correction process. It's possible that a misspelled name could lead to accounts that are not yours being added to your report.

In reply to “ . The credit bureau must by what’s the point

If you've already tried reaching out to the credit reporting company and still have an issue, you can submit a complaint to the Consumer Financial Protection Bureau. The CFPB will forward your complaint the company and work to get you a response, generally within 15 days.

In reply to I don't have enough fingers by TimeWasted

If you've already tried reaching out to the credit reporting companies and still have an issue, you can submit a complaint to the Consumer Financial Protection Bureau. The CFPB will forward your complaint the company and work to get you a response, generally within 15 days.

In reply to I have been making regular by kamziz

If you've already tried reaching out to the credit reporting company and still have an issue, you can submit a complaint to the Consumer Financial Protection Bureau. The CFPB will forward your complaint the company and work to get you a response, generally within 15 days.