Every day people report to the FTC the scams they spot. Every year, the FTC shares the information we collect in a data book which tells a story about the top scams people tell us about – so we can all spot and avoid them.

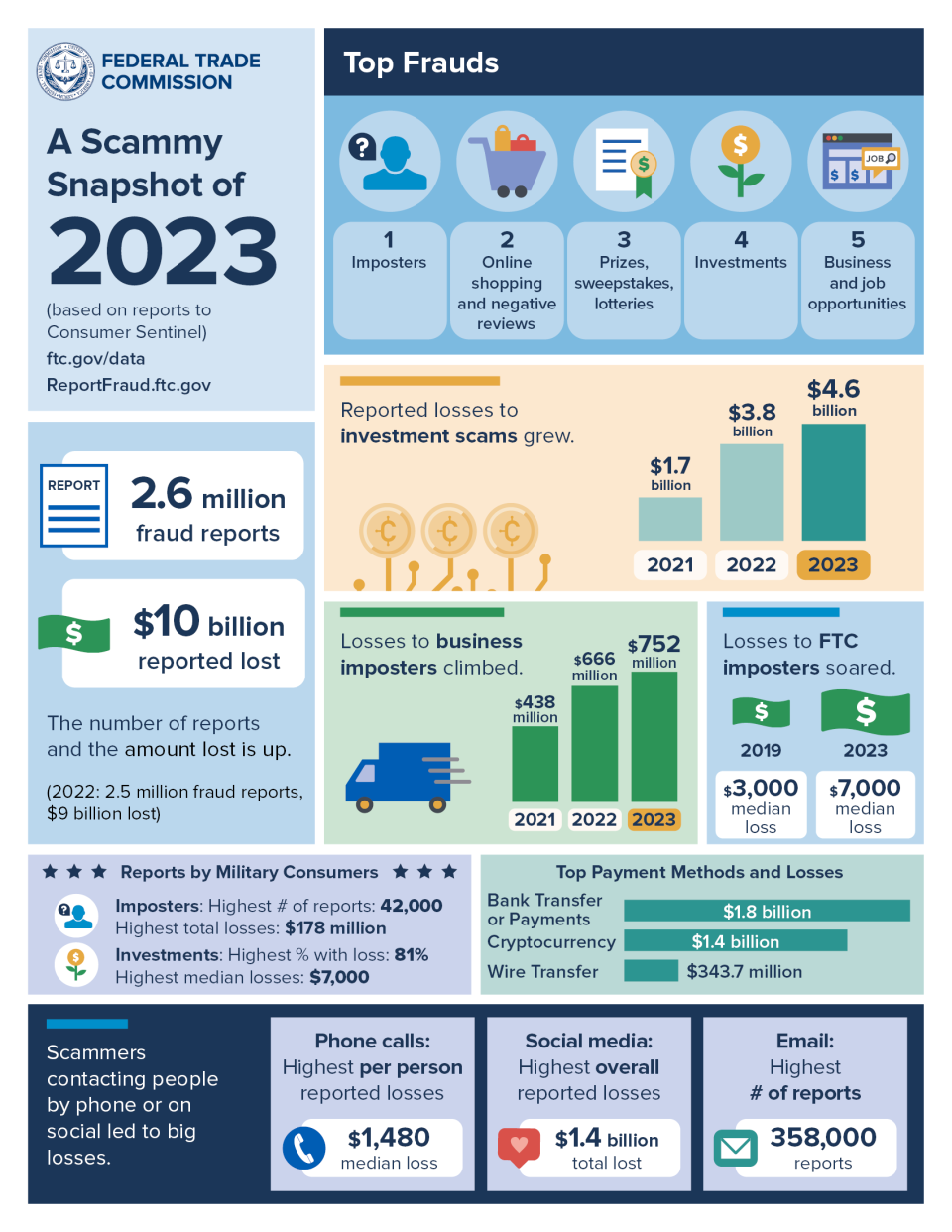

The Data Book tells us that people lost $10 billion to scams in 2023. That’s $1 billion more than 2022 and the highest ever in reported losses to the FTC – even though the number of reports (2.6 million) was about the same as last year. One in four people reported losing money to scams, with a median loss of $500 per person. And email was the #1 contact method for scammers this year, especially when scammers pretended to be a business or government agency to steal money.

Here are other takeaways for 2023:

- Imposter scams. Imposter scams remained the top fraud category, with reported losses of $2.7 billion. These scams include people pretending to be your bank’s fraud department, the government, a relative in distress, a well-known business, or a technical support expert.

- Investment scams. While investment-related scams were the fourth most-reported fraud category, losses in this category grew. People reported median losses of $7.7K – up from $5K in 2022.

- Social media scams. Scams starting on social media accounted for the highest total losses at $1.4 billion – an increase of 250 million from 2022. But scams that started by a phone call caused the highest per-person loss ($1,480 average loss).

- Payment methods. How did scammers prefer that people pay? With bank transfers and payments, which accounted for the highest losses ($1.86 billion). Cryptocurrency is a close second ($1.41 billion reported in losses).

- Losses by age. Of people who reported their age, younger adults (20-29) reported losing money more often than older adults (70+). However, when older adults lost money, they lost the most.

Check out the graphic for the top scams of 2023. Read the 2023 Data Book for more details and to learn what happened in your state.

Want to protect yourself, your loved ones, and your communities from scams? Go to ReportFraud.ftc.gov to report fraud. Reports like yours help law enforcement take action with education and enforcement. By reporting what you see and experience, you can help protect your community.

Beware also of emails that can be "ghosted". The scammer can make your email look legitimate and send it to one of your clients asking them to pay their bill. They may state that the address has changed and the banking information is different (because they are fraudsters and they are stealing from you and the client). Watch out for language that looks different than usual in the email.. The client can be fooled and send money to a bank that your business doesn't use and thereby scam both you and the client. This happened in my husband's business but the bank's fraud department resolved it. Just be aware and careful! It's a crying shame that there are so many fraudsters out there but we have to stay vigilant.

Why no named scam websites?

Pagination