Most people go to college to earn a degree and get a good job. In a competitive job market, it helps to have connections. So when a college or university claims it has relationships with well-known employers, that may convince you to attend. But beware: Claims like this may be a ploy to attract new students — and your tuition dollars. In fact, the FTC says that’s just what one for-profit university did as part of an extensive advertising campaign.

In a proposed settlement announced today, the FTC says that for-profit University of Phoenix, and its parent company, Apollo Education Group, Inc., falsely claimed that their relationships with top companies created job opportunities specifically for Phoenix students and deceptively claimed they worked with these companies to develop courses.

The FTC says that University of Phoenix used a multi-media ad campaign to attract students, including ads specifically targeted to military and Hispanic consumers. The companies’ “Let’s Get to Work” campaign featured several high-profile employers, including Microsoft, Twitter, Adobe, and Yahoo!, giving the false impression that UOP worked with those companies to create job opportunities for its students.

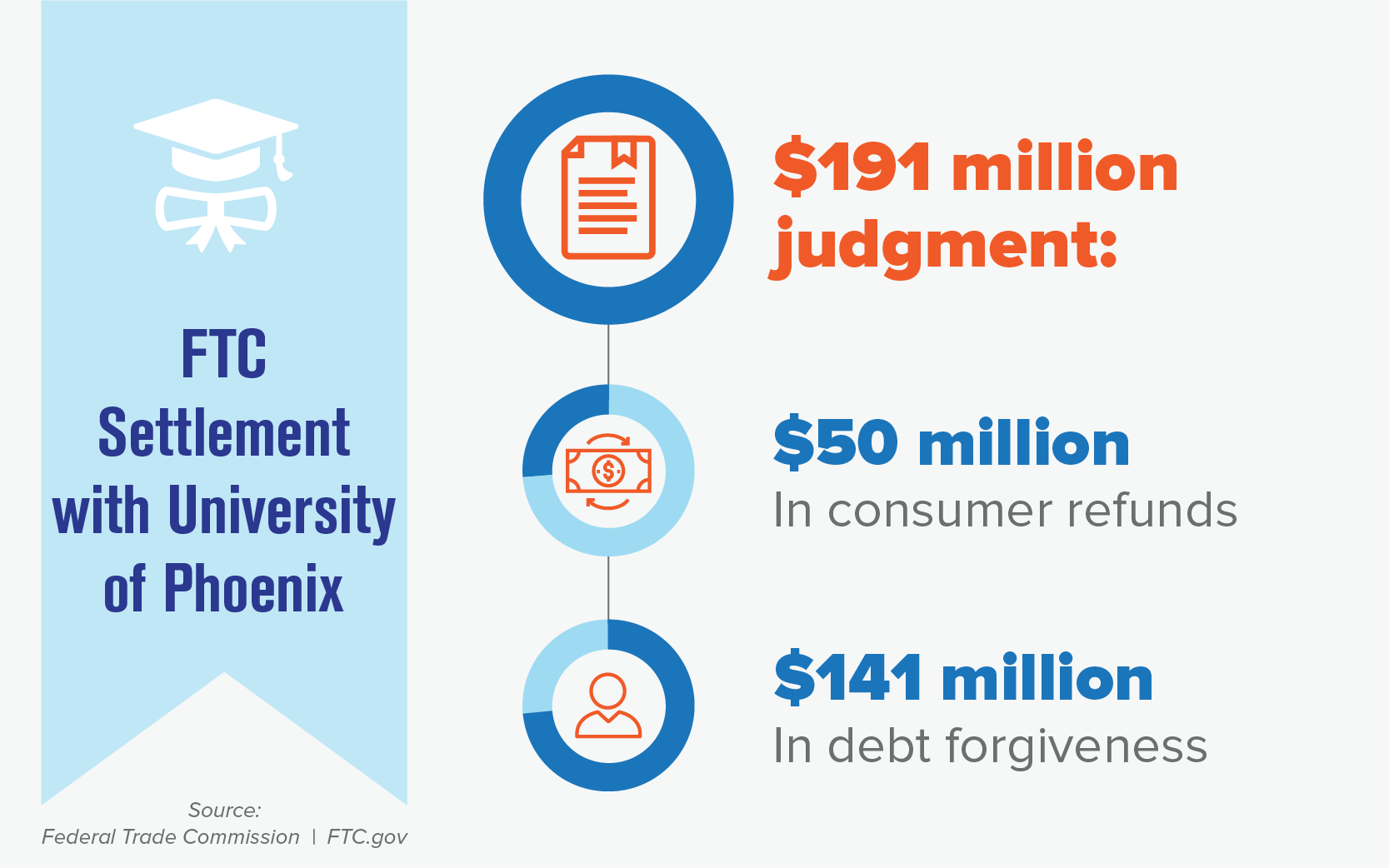

As part of the $191 million settlement, the companies will return $50 million in cash to former students and cancel $141 million in student debt owed directly to the school. The proposed order prohibits the companies from further deceptive business practices. In addition, it requires them to ask consumer reporting agencies to delete the debts from people’s credit reports, give notice to those who got debt cancellation, and make sure people have access to their diplomas and transcripts.

Before enrolling in school, it’s important to do your homework. You can get important information about any school at the U.S. Department of Education’s College Navigator. For example, if you enter a school’s name, you can find out if it’s public or private, for-profit or non-profit, its accreditation status, and its student loan default rates.

Also, check out what are people are saying about schools you’re considering. Search online for the school’s name plus words like “review,” “complaint” or “scam.”

If you’re looking to advance your education, do your homework to be sure you know what you’re paying for. Check out Choosing a College: Questions to Ask.

Added on December 19, 2019: The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to FTC, can you please provide by Former Student…

The debt owed directly to the school is money people owe directly to University by people who first enrolled between October 1, 2012 and December 31, 2016, that the University could collect or transfer to a collection agency. Read the Settlement Agreement for more information.

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to Will this apply to MBA by UnfinishedMBA

Students who took classes online could be covered by the settlement between the FTC and University of Phoenix, but the settlement does not affect your private loans or federal government loans.

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016.

In reply to So do the people that took by mamabear

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to The FTC will identify people by FTC Staff

In reply to When will University of by colochas29

The University of Phoenix started notifying people around mid-December.

To get email updates from the FTC about this settlement, please sign up here.

In reply to I enrolled in school August by roshandaroberts

Do you owe money directly to the University for fees or some other kind of charge?

The University will cancel the debts owed directly to the school by people who enrolled for the first time between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to So for the students that by Bthom1122

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to I attended the University of by sr70

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to I attended UOP, but did not by Susan

Do you owe money directly to the University for fees or some other kind of charge?

The University will cancel the debts of students who owe fees or other charges directly to the school, for students who enrolled for the first time between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to I went to school from 2011 by Tathiana Villanueva

The FTC will identify people who are eligible for a payment from the $50 million University of Phoenix settlement with the FTC. That could include people who used military benefits. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to I went to school from 2011 by Tathiana Villanueva

In reply to When I was signed up the by RWilson

Axia College of University of Phoenix was the online 2-year degree branch of the University of Phoenix.

In reply to I enrolled in 2015 and will by Rlynnm21

The settlement between the FTC and University of Phoenix doesn't affect your private or federal student loans.

In reply to The settlement between the by FTC Staff

In reply to I enrolled in 2013 to 2017 it by Dee Nice

Do you owe money directly to the University for fees or some other kind of charge? The University will cancel the debts of students who owe fees or other charges directly to the school, for students who enrolled for the first time between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to I attended the University of by Jose

The University also paid $50 million to the FTC as part of the settlement. The FTC will identify people who are eligible for a payment from the $50 million the University paid to the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to if you took out a federal by Ellen

The settlement between the FTC and the University of Phoenix does not affect your private loans or federal government loans.

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

The University also paid $50 million to the FTC as part of the settlement. The FTC will identify people who are eligible for a payment from the $50 million the University paid to the FTC. You don’t have to apply or submit a claim to get a payment. If you would like to get email updates about this settlement, please sign up here.

In reply to The time frame refers to the by VReyes27

Axia College of University of Phoenix was the online two-year degree branch of the University of Phoenix. If you first enrolled at Axia College of the University of Phoenix in 2008, that is like you first enrolled at University of Phoenix in 2008.

In reply to I attended UOP during that by BoxWhatBox

The settlement between the FTC and the University of Phoenix does not affect your private loans or federal government loans.

Do you owe money directly to the school?

Under the settlement, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016. The University will send a notice to each person whose debt to the school is being cancelled.

In reply to I was sent to a collection by Nate

Do you owe money directly to the University?

Under the settlement between the FTC and the University of Phoenix, the University will cancel $141 million in debts that are owed directly to the school by people who first enrolled at the school between October 1, 2012 and December 31, 2016.

Pagination