We expect banks and brokers to keep our money safe. We think they’ll stop or warn us about suspicious transfers out of our accounts. But do they? Scammers are exploiting that trust and getting people to transfer their money and drain their retirement accounts to “protect” or “safeguard” or “legalize” it. The truth? The money gets stolen, and banks and brokers won’t get it back from the scammer.

Lots of financial ads talk about “zero liability” for fraud, so it’s easy to think your bank accounts and retirement funds are covered too. Think again. Bank accounts have different (and fewer) protections than credit cards:

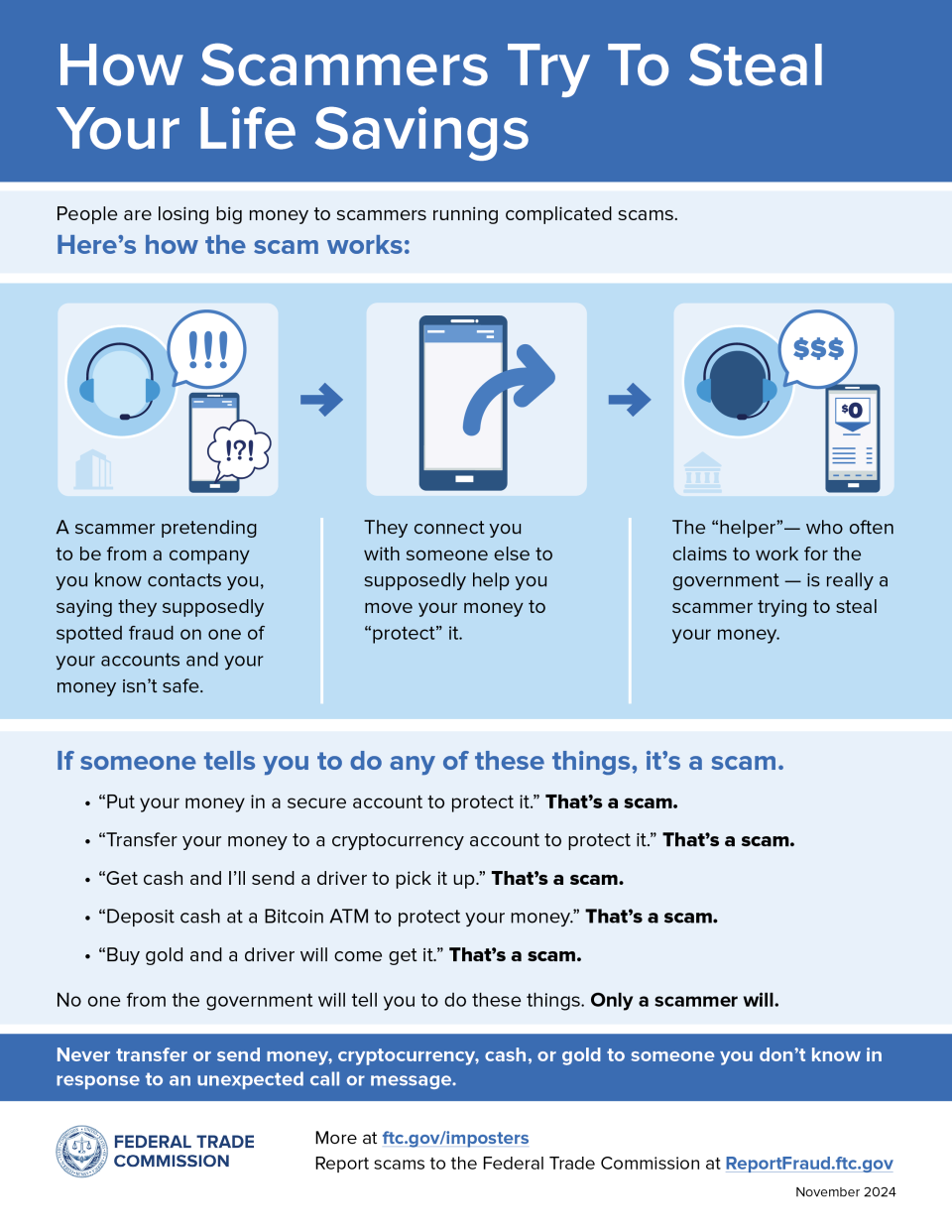

- If you are scammed into moving your money out of your account, you won’t be protected if it turns out to be a scam. And you probably won’t get that money back.

- If you transfer your life savings into a cryptocurrency wallet because someone told you to, it’s nearly impossible to get it back.

- If you liquidate your retirement account and hand the cash over to someone else, the bank will not reverse the transaction. No matter how much you need your life savings, it’s gone.

If someone tells you to move your money to “protect” it, that’s outright theft. Remember:

- If it involves your bank account, retirement account, or life savings: stop. Hang up the phone. Call your bank or broker directly using a number you KNOW is right — not the number the caller used or gave you.

- Tell someone. Scammers want to isolate you from people you know and trust. Never agree to keep a secret — especially if you’re scared and worried. Always tell a family member or friend you trust — they care and can help.

- Listen and share. The bank teller or employee might not know you, but they do know the signs of fraud. If they ask, share why you're withdrawing cash. Let them help you figure out what's really going on.

- Don’t lie. The scammer, who might even try to keep you on the phone, will tell you to lie, so the bank won’t stop your transfer. Do not lie to avoid the bank’s security department.

Remember, if you get a call, email, or text message from someone you think is trying to scam you, report it as soon as you can to the FTC at ReportFraud.ftc.gov.

I'm 86 years old, but, as a retired government official, I have always been aware of and careful with my financial accounts. My only purpose for this email is to THANK YOU for the work that you do in this, so necessary and valuable, consumer service. Your work, along with that of the equally valuable Consumer Financial Protection Agency, is vital in this new world of predatory financial activity; some of this even by major U.S. financial institutions, including some that are being prosecuted by you. Thanks too, to political representatives like Senator Liz Warren, Representative Katy Porter, etc., who actively support this important work, against the efforts of a number of politicians who actively attack increased government financial regulation.

In reply to I'm 86 years old, but, as a… by Hank Rodgers

They been hacking me scamming me with gambling and my bank accounts and investing accounts and also I wonder if they let me buy a house are scammers trying to get money from me investing please help me because I don't want to get into trouble

"We expect banks and brokers to keep our money safe. We think they’ll stop or warn us about suspicious transfers out of our accounts. But do they?"

I so appreciate the FTC articles. HOWEVER, this is written in such a way to grab a headline and make banks look bad. Please fix that to be reflective of the truth. All the safeguards in the world put in place by the bank cannot always stop the consumer from giving the money to the scammer.

Banks are not the bad guys here and should not be made out to be.

In reply to "We expect banks and brokers… by Julie J Bailey

Yes the bank is not the bad guy here, but whom much is given much is expected!!! The bank is expected to put all its security expertise to use to secure had earn money of the clients, even when such withdrawal looks unusual the bank should delay and send in some institutional investigation tactics to protect the funds and the clients, all signs are always there when scammers are out against the innocent people!!!! Thank you

This information is very helpful but far too late for me. I was scammed a year ago out of $30,000.00. The scammer used all the ploys mentioned in your article. I really wish I could have read this before it happened. I have told only one person about what happened to me because I was so frightened and manipulated by the scammer. And Chase bank offered no help whatsoever. I am still sick over this. It happened at the same time that I was diagnosed with breast cancer. So needless to say, I was devastated.

Why are the banks getting away with this? I DID NOT AUTHORIZE anyone access to transfer all my money out of my acct THEY DID! They didn't even use the red flag rules or I would have had some money left, but they did not! I had no idea this was even possible! I didn't give a out my info either! Bunch of fraud all the way around! Only I suffered!!

In reply to Why are the banks getting… by Denise D Marti

Dear Denise,

We are victims of 3 banks involved in stealing money from first my father, then me and the business we owned and by placing fraud on my credit report in order to stop the transfer of control of the business back to me the first founder. I’m sorry for your suffering. The banks learned with their bailouts pursuant to October 28th that they could steal from and allow others to steal large sums of money and assets from their customers if it benefited a preferred customer or customers with a lot more money than their victims.

When I caught them they stalked and robbed me in multiple states to stop prosecutions of them and the monopoly customers.

Blessings and recovery prayers to you.

Why do Facebook allow this to happened. Obviously they don't care about the there customers. Facebook is a scam. There getting paid by the people they allow to scam there client's. Thanks for the info but as long fb is allowed to keep letting scammers advertise

we will continue dealing with scammers. Fb is greedy. And only concern about $$$. Scammers pay for advertisment who gets that money .

Not only will your bank not stop you from transfering but they will allow anyone access to be a coowner on your account. The bank will lock you r funds and even inform you.

Bank Of America to be exact! Recently widowed 81 yo unable to buy groceries or update any auto payment accounts.

In reply to Not only will your bank not… by L C

I'm just now dealing with an Unauthorized wire transfer to the bank of America, I promise whom ever will not like my response ❤️🙏🤭

I don't know where else to turn. I did not receive my monthy social security check in my direct deposit last Wednesday, April 10th. I called the SS Administration, but didn't get any satisfaction or help. I have online banking and am keeping an eye on it. Can you please help me, or steer me in the right direction. As I am retired and disabled, I need my money,